Expert Tips for Effective Bookkeeping Spay050

Effective bookkeeping is crucial for business success. It requires a strategic approach that incorporates technology, fundamental financial principles, and consistent practices. By embracing cloud solutions and maintaining accurate records, businesses can improve efficiency and integrity. Additionally, regular reviews of accounts play a pivotal role in financial health. Understanding these elements can transform bookkeeping from a mundane task into a powerful tool for informed decision-making. What specific strategies can further enhance this essential function?

Embrace Technology for Streamlined Bookkeeping

As businesses increasingly navigate a complex financial landscape, embracing technology for streamlined bookkeeping has become essential.

Utilizing cloud software allows for real-time data access and collaboration, enhancing efficiency. Automated tools further reduce human error and save time, enabling businesses to focus on growth and strategic decision-making.

Understand Key Financial Principles

A solid grasp of key financial principles is crucial for effective bookkeeping and overall business success.

Financial literacy enables individuals to interpret financial statements accurately, while effective budgeting strategies ensure resources are allocated efficiently.

Understanding these concepts empowers business owners to make informed decisions, fostering autonomy and growth.

Mastery of financial principles ultimately enhances a company's financial health and operational effectiveness.

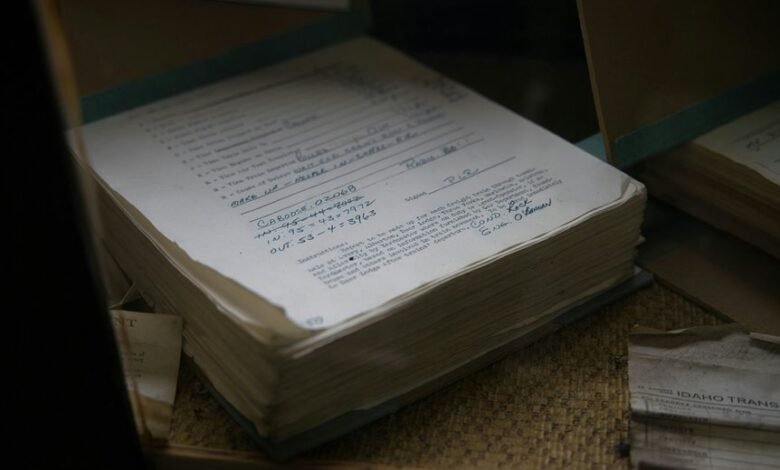

Maintain Consistency in Record Keeping

While many elements contribute to effective bookkeeping, maintaining consistency in record keeping stands out as a foundational practice that enhances accuracy and reliability.

Consistent record organization fosters data accuracy, ensuring that financial information is readily accessible and verifiable. This discipline not only streamlines operations but also supports informed decision-making, empowering individuals to manage their finances with confidence and clarity.

Regularly Review and Reconcile Your Accounts

Regularly reviewing and reconciling accounts is essential for maintaining financial integrity and accuracy.

This practice ensures that account statements align with recorded transactions, promoting transaction accuracy.

By systematically comparing financial records with bank statements, discrepancies can be identified and corrected timely.

Such diligence not only safeguards against potential errors but also empowers individuals to manage their financial resources with confidence and freedom.

Conclusion

In conclusion, effective bookkeeping serves as the bedrock of financial stability and growth for any enterprise. By embracing modern technology, understanding key financial principles, maintaining consistent records, and regularly reviewing accounts, businesses can cultivate an environment of accuracy and informed decision-making. Just as the quill was once indispensable for documentation, today's cloud-based solutions are paramount for efficiency and collaboration. Adopting these practices not only enhances operational integrity but also positions businesses to thrive in an ever-evolving marketplace.